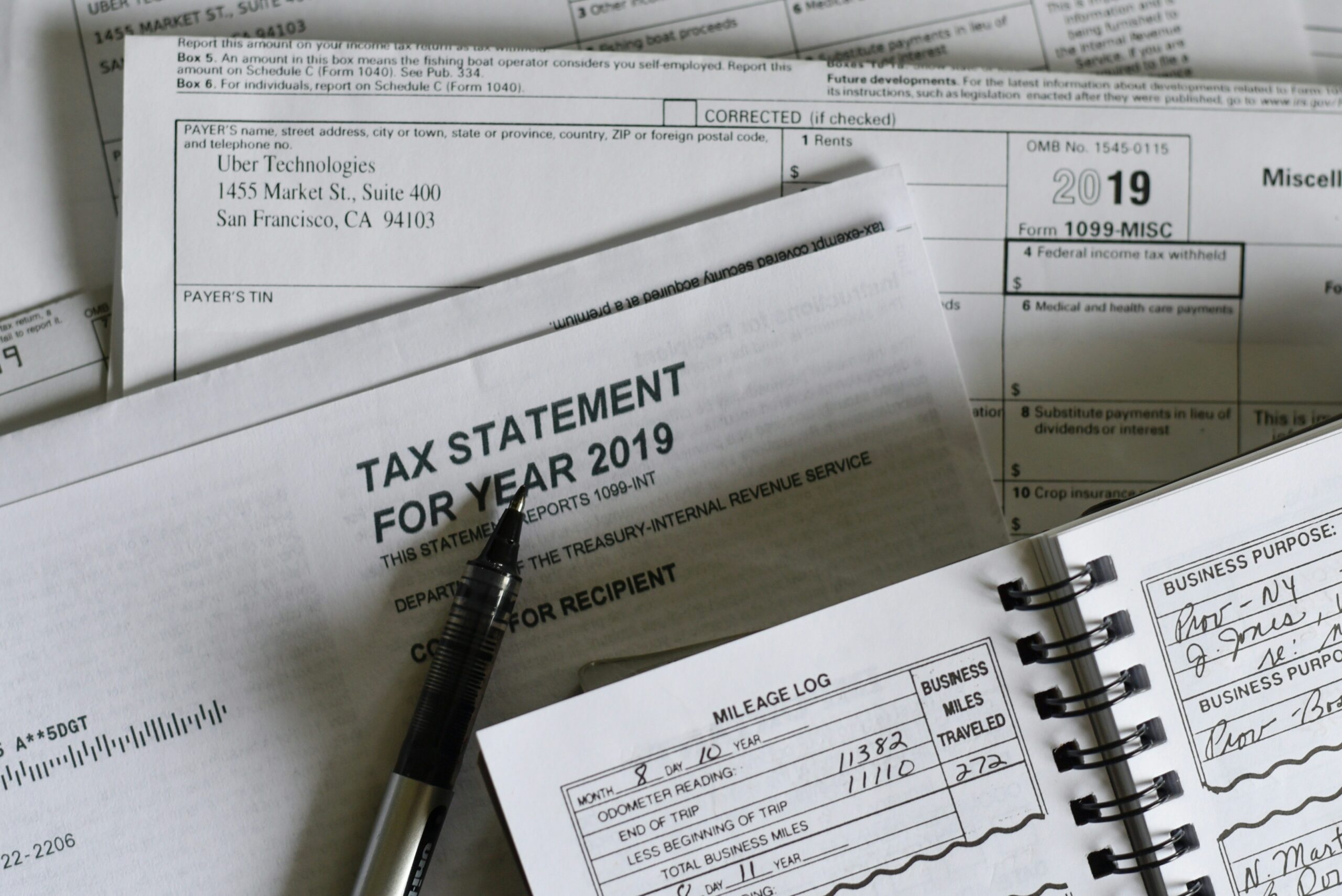

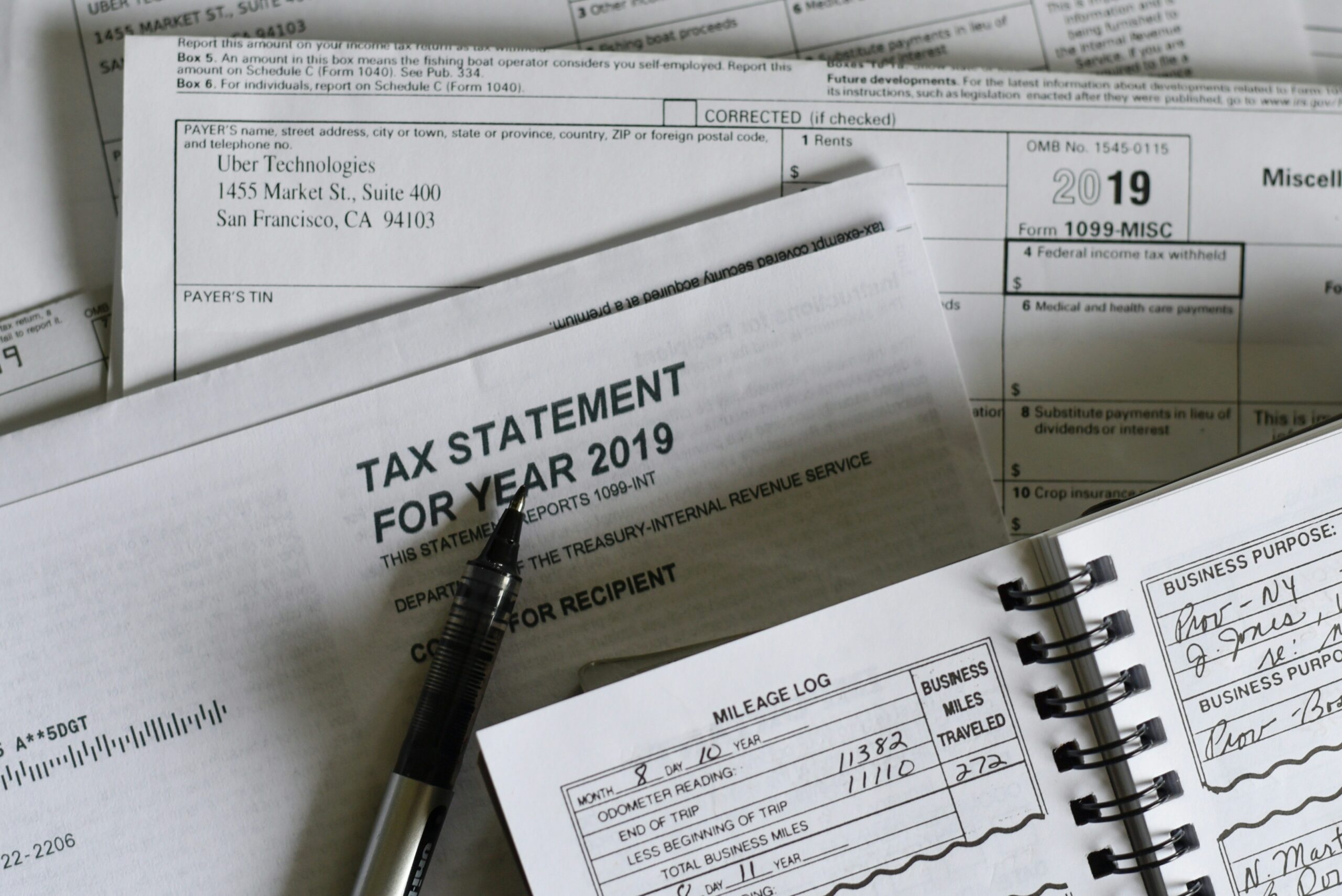

Thailand Income Tax

Thailand income tax system operates under: Revenue Code B.E. 2481 (1938), as amended Specific tax acts (e.g., Petroleum Income Tax Act) Ministerial Regulations (issued by the Ministry

Your Udon lawyers in Thailand

Check out the latest post from our blog

Thailand income tax system operates under: Revenue Code B.E. 2481 (1938), as amended Specific tax acts (e.g., Petroleum Income Tax Act) Ministerial Regulations (issued by the Ministry

Translation and Legalization in Thailand. In an increasingly globalized world, the need for accurate translation and proper legalization of documents has become essential for individuals

The Foreign Business Act B.E. 2542 (1999) (FBA) governs the operation of foreign-owned businesses in Thailand. Its objective is to regulate foreign participation in sensitive

Property taxes in Thailand are levied on property owners, buyers, and sellers to regulate transactions and generate government revenue. Understanding these taxes is essential for

Mergers and acquisitions in Thailand involve complex legal, financial, and regulatory processes influenced by the Foreign Business Act (FBA), tax regulations, and compliance with Thai

A business partnership in Thailand is a formal arrangement between two or more parties who collaborate to run a business. Partnerships in Thailand are governed